The History and Origins of Currency

Where It All Began: Barter, Beads, and Beyond

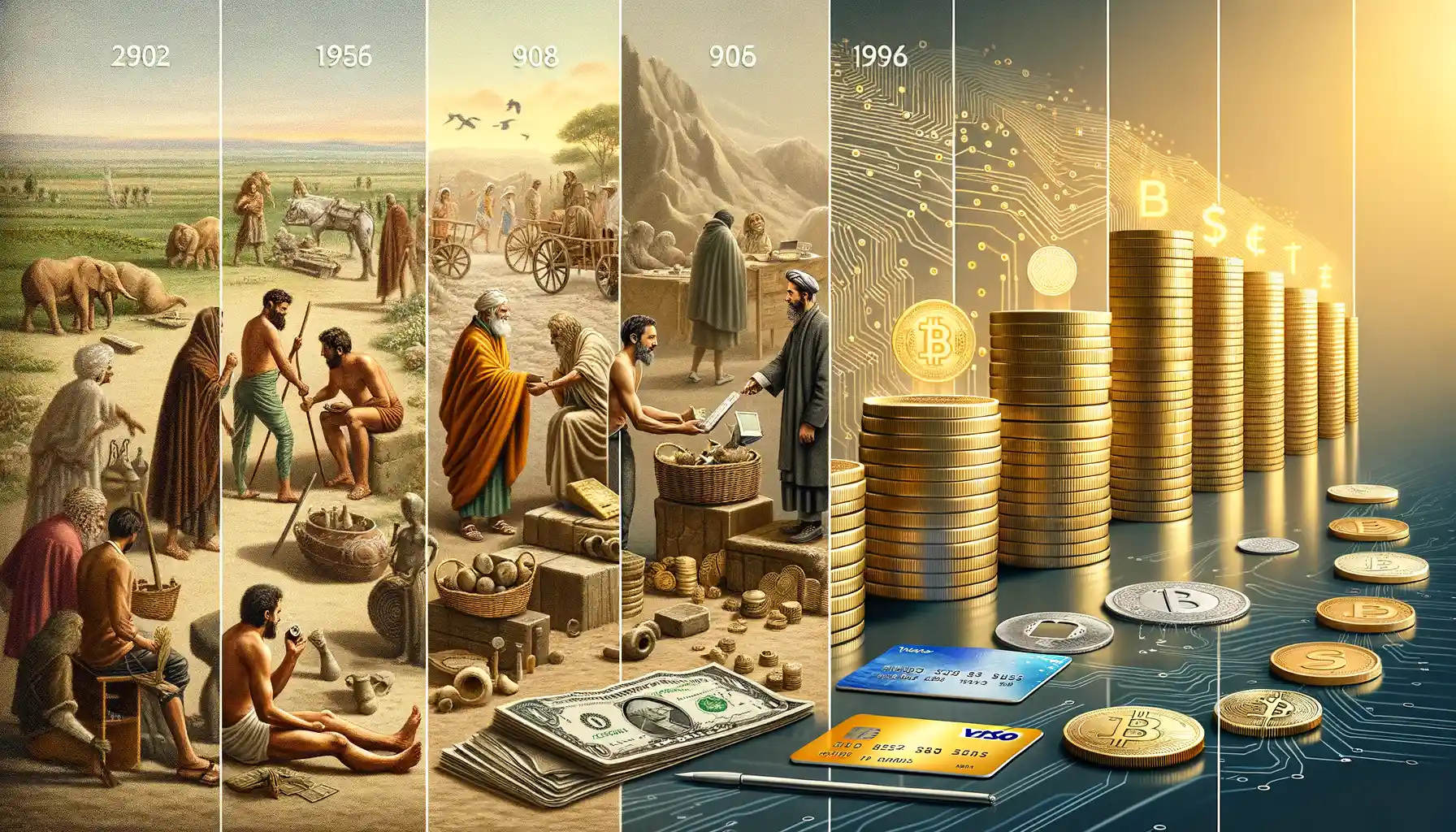

Money didn’t always jingle in your pocket or tap its way through your smartphone. Its story begins thousands of years ago with barter. Imagine, trading a sack of grain for a goat—sounds simple, right? But what happens when you need shoes, not a goat? Enter the first solution: items of agreed value like shells, beads, and even salt. Yes, *salt*! This “white gold,” as it was known, became currency because it was vital and universally needed.

The leap forward came when ancient civilizations got clever. The Lydians (around 600 BCE) struck the first **metal coins** from **electrum**, a natural gold-silver alloy. Then came the Romans, stamping emperors’ faces onto coins, blending money with propaganda. Suddenly, wealth could clink in your hand, rather than being tied to bulky goods.

A World Built on Trust

Here’s where things get interesting. Paper money didn’t catch fire immediately—it was fragile! Yet, by the Tang Dynasty (China, 7th century), merchants began using **paper promissory notes**, precursors to banknotes, for big transactions. Why? Coins were heavy; trust made trade easier. Fast forward, and this trust-based system—the guarantee that a piece of paper or coin holds value—changed everything.

Key Milestones in the Transformation of Money

The Dawn of Trade: Barter to Metal Coins

Imagine a world where every transaction felt like a puzzle—swapping goats for grain, pottery for tools. This was the era of barter, where trade meant a delicate dance of needs and wants. But humans are ingenious, aren’t they? To simplify the chaos, ancient civilizations created the first universally accepted form of value: **metal coins**. Think about it—these shiny, portable treasures made trading feel magical. The **Lydians** were among the first (7th century BCE) to mint coins, mixing gold and silver into “electrum.” Suddenly, markets were buzzing, and wealth became something you could hold in your hand.

Paper Money and the Promise of Trust

Fast forward a few centuries, and another leap transformed economies: **paper money**. It wasn’t just lighter; it was revolutionary. By the Tang Dynasty in China (around 7th century CE), banks issued notes as IOUs. Imagine a humble farmer with a slip of paper that promised value—confidence wrapped in ink! European explorers couldn’t believe their eyes when they encountered this system. Soon, nations like Sweden and England caught on, sprinkling the world with currencies backed by government trust.

- Barter’s fall to coins marked society’s first monetary revolution.

- Banknotes bridged gaps between value and trust, empowering global trade.

The Rise of Digital and Cryptocurrency

The Digital Revolution: When Money Met Technology

The transformation of money took a seismic leap when technology entered the scene. Picture this: your wallet shrinking, yet your purchasing power expanding into a boundless digital universe. From online banking to mobile payment apps like Apple Pay and PayPal, physical cash started feeling—well, almost nostalgic. Suddenly, with just a few taps on a screen, transactions crisscrossed the globe faster than ever before.

But then came the game-changer that stole the spotlight: cryptocurrency. Enter Bitcoin in 2009, a mysterious new kid on the block, born out of an idea that currency could exist without central banks or borders. It was radical, it was rebellious, and it quickly inspired an entire ecosystem of decentralized digital coins—from Ethereum‘s smart contracts to the meme-worthy rise of Dogecoin.

- Blockchain: the invisible backbone of cryptocurrency, a technology ensuring transparency and security.

- Mining: Imagine virtual prospectors solving puzzles to extract digital gold—this is how cryptocurrencies are created.

For many, cryptocurrencies weren’t just a tech fad—they symbolized empowerment. The power to store value or transfer wealth without interference became a siren call for innovators and libertarians alike.

Impacts of Modern Currency on Global Economy

The Ripple Effect of Digital and Cryptocurrencies

The world is spinning faster with the rise of modern currency. From the clinking of coins to the invisible hum of blockchain, today’s financial systems are woven into a global tapestry that constantly shifts and evolves. Think about it: a simple tap on your phone can send money halfway across the globe—no borders, no delays. This isn’t just convenience; it’s a revolution.

Modern currencies like Bitcoin and Ethereum are shaking up traditional markets. Take the remittance industry, for example. Families who used to lose chunks of their hard-earned wages to high transfer fees are now turning to cryptocurrencies. In seconds, funds arrive with fewer fees and no middlemen. If that doesn’t scream empowerment, what does?

- Global trade: Digital currencies reduce barriers and build new bridges for businesses, especially in emerging economies.

- Inflation woes: Nations like Venezuela have turned to Bitcoin as a lifeline when their national currency collapses.

But here’s the flip side: volatility. One day you’re riding high, watching Bitcoin skyrocket, and the next, it’s tanking. The global economy must learn to dance delicately with this new partner—it’s a tango, not a waltz.

Future Trends in the Evolution of Money

A World of Seamless Transactions

Imagine a future where you never fumble for coins or cards at the checkout counter. The evolution of money is charging forward, and we’re headed into an era of *frictionless* transactions. With technologies like blockchain, artificial intelligence (AI), and biometric systems, paying for your morning coffee might someday be as simple as a smile or a wave of your hand.

Think about it: digital wallets that predict your spending habits, cryptocurrencies integrated into everyday shopping, and even wearable devices doubling as your bank account. The lines between physical and virtual worlds are blurring, and money is following suit.

- Central Bank Digital Currencies (CBDCs): Countries around the globe are racing to launch their own digital currencies, reshaping the way governments and citizens interact financially.

- Programmable Money: Imagine currency embedded with code — autopaying bills or releasing funds only on specific conditions. Welcome to smart money!

The Role of Decentralization and Inclusivity

Beyond convenience, the future of currency holds a promise: greater financial inclusion. Decentralized finance (DeFi) could empower billions who lack access to traditional banking systems. Picture a farmer in rural Kenya using cryptocurrency to secure a loan or someone in Argentina safeguarding their savings from hyperinflation through Bitcoin.

And yet, it’s not just about the unbanked. Power is shifting from giant financial institutions to individuals. Blockchain networks mean no middlemen—just people transacting value directly. It’s a revolution… one block at a time.